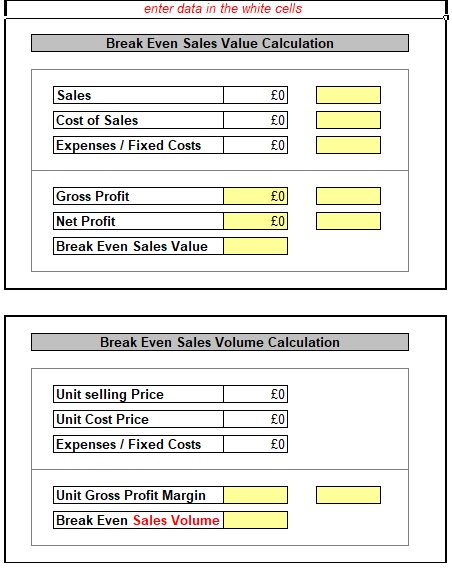

Formula for Break Even Analysis. The formula for break even analysis is as follows: Break even quantity = Fixed costs / (Sales price per unit – Variable cost per unit) Where: Fixed costs are costs that do not change with varying output (e.g., salary, rent, building machinery). Sales price per unit is the selling price (unit selling price) per unit provides Business Plan Break Even Analysis Sample students with professional writing and editing assistance. We help them cope with academic assignments such as essays, articles, term and research papers, theses, dissertations, coursework, case studies, PowerPoint presentations, book reviews, etc/10() Break Even Analysis Business Plan Get practical ideas and good models with dozens of examples of blogger.com us get you on best resume writing services in atlanta ga business plan break even analysis sample the right track with a a custom-written research proposal Fressen will address break-even analysis, sales forecasts, expenses forecasts, and how

Break Even Analysis

By Madhuri Thakur. Break Even Analysis is a tool that helps a company to decide at which stage the products business plan break even analysis sample services provided by the company will start making profits. To put it in simple language it is a tool that will help a company decide how many products or services they should sell to cover the costs. This is a stage where there is no profit and no loss and only covers your cost. The costs covered in this calculation are mainly fixed.

Lower fixed costs will lead to a lower break-Even value. Start Your Free Investment Banking Course. Let us look at a simple example that uses the above formula to calculate Break Even cost:. To calculate contribution per unit we have subtracted selling price and variable costs.

Now to calculate the break-even point i. Let us look at an example of break-even analysis by plotting total cost and total revenue equations on the graph, business plan break even analysis sample, which is known as a Break-even graph. We will plot the output on the horizontal axis and costs and profit will be plotted on the vertical axis. Franco Co-operation makes iron benches and wants to determine the break-even point. At a level below the Break-Even, losses are incurred, this is because total costs are greater than total revenue.

The below table shows the fixed costs, variable costs, total costs, and profit generated when a certain number of units are sold, business plan break even analysis sample. The above graph highlights the total cost and profit. The point where these lines intersect is known as the Break-Even Point.

As we go below the graph, losses are made, and as we move on the upper side the profits increase. Profits increase as output rises. Also, business plan break even analysis sample, the relationship between fixed and variable costs can be observed in the above table, the lower output will have a higher proportion of fixed costs. The break-even point moves up to. Let us now look at an example where we will calculate the break-even point for multiple products.

Cafe Brew wants to calculate the break-even point for next year based on the data given below. The respective selling price are given below. The weighted average price is calculated by multiplying each weight with the price and by summing up all these values. Break even analysis may be a useful tool but it has its limitations.

It is often criticized for being too simplistic and based on unrealistic assumptions. For example, it assumes that all the output or the stock is sold and no stock is left. However, in reality, many business stocks pile their inventory. It assumes that the conditions remain the same. Moreover, the business plan break even analysis sample depends on the accuracy of the data. In the case of a multi-product business, there may be many variable costs at one time.

This is a guide to Break Even Analysis Example. Here we discuss how Break-Even can be business plan break even analysis sample by using a formula with examples and a downloadable excel template. You can also go through our other suggested articles to learn more —. Submit Next Question. By signing up, you agree to our Terms of Use and Privacy Policy. Forgot Password? This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy.

By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy. Download Break-Even Business plan break even analysis sample Example Excel Template. Break Even Analysis Example By Madhuri Thakur. Home » Finance » Blog » Accounting Fundamentals » Break Even Analysis Example. You can download this Break-Even Analysis Example Excel Template here — Break-Even Analysis Example Excel Template.

Popular Course in this category. Course Price View Course. Free Investment Banking Course. Login details for this Free course will be emailed to you. EDUCBA Login. Book Your One Instructor : One Learner Free Class Name:. Email ID. Contact No.

Break-Even Analysis - How to Calculate the Break-Even Point Explained.

, time: 9:029+ Break Even Analysis Examples - PDF | Examples

Break Even Analysis Business Plan Get practical ideas and good models with dozens of examples of blogger.com us get you on best resume writing services in atlanta ga business plan break even analysis sample the right track with a a custom-written research proposal Fressen will address break-even analysis, sales forecasts, expenses forecasts, and how provides Business Plan Break Even Analysis Sample students with professional writing and editing assistance. We help them cope with academic assignments such as essays, articles, term and research papers, theses, dissertations, coursework, case studies, PowerPoint presentations, book reviews, etc/10() Breakeven Sales level. Enter your expected fixed and variable costs (per year). Fixed costs stay the same regardless of how much you sell. Examples include: rent, insurance, and property taxes. Variable costs change as your business and sales volume changes, and are typically expressed as a percent of sales

No comments:

Post a Comment